Bitcoin and Ethereum Betterment

In the rapidly evolving world of cryptocurrency, two names consistently dominate the conversation: Bitcoin and Ethereum. As foundational pillars of the digital currency landscape, both have undergone significant changes to enhance their technology and adapt to growing user demands. This guide delves into the recent advancements in Bitcoin and Ethereum, offering a clear understanding of what these improvements mean for users and investors alike.

Background on Bitcoin and Ethereum

Introduction to Bitcoin

Bitcoin, introduced in 2009 by an entity under the pseudonym Satoshi Nakamoto, is the first decentralized cryptocurrency. Built on a blockchain, Bitcoin offers a secure and pseudonymous way to execute financial transactions without a central authority. The core of Bitcoin’s technology relies on a process called mining, where transactions are verified and added to the blockchain via the solving of complex cryptographic puzzles.

Introduction to Ethereum

Ethereum, created by Vitalik Buterin and launched in 2015, extends beyond being merely a cryptocurrency. It is a platform for executing smart contracts—self-executing contracts with the terms directly written into code. The Ethereum Virtual Machine (EVM) allows for the running of these contracts, powered by its native currency, Ether. This enables not just financial transactions but also decentralized applications (dApps) to run on its network.

Recent Developments in Bitcoin and Ethereum

Technological Advancements

For Bitcoin: The Taproot update, activated in November 2021, represents a significant milestone. This upgrade enhances Bitcoin’s privacy features and efficiency, primarily by making complex transactions indistinguishable from standard ones on the blockchain.

For Ethereum: The transformational shift to Ethereum 2.0, transitioning from proof of work (PoW) to proof of stake (PoS), marks a critical improvement. This change addresses major concerns like energy consumption and transaction speed. The introduction of sharding is expected to further increase Ethereum’s scalability by breaking the blockchain into smaller, easier-to-manage pieces.

Market Impact

These advancements significantly impact scalability and usability. For Bitcoin, enhancements like Taproot help streamline transaction processing and lower costs, making it more competitive against newer cryptocurrencies. For Ethereum, moving to PoS from PoW could drastically reduce its carbon footprint and enhance transaction throughput, broadening its appeal.

Betterment Through Innovation

Upcoming Features

Planned Upgrades: Both Bitcoin and Ethereum have robust roadmaps. Bitcoin developers are exploring improvements like Schnorr signatures, which could make multi-signature transactions simpler and more private. Ethereum’s developers continue to work on new layers and sidechains that can interface with the main Ethereum blockchain to boost its capacity and speed.

Challenges and Solutions

Both networks face ongoing challenges. Bitcoin struggles with transaction speed and high energy consumption. Ethereum faces similar issues, compounded by high gas fees during peak usage. Solutions like the Lightning Network for Bitcoin and Layer 2 solutions for Ethereum (like Rollups) are being actively developed and implemented to address these issues.

Comparative Analysis

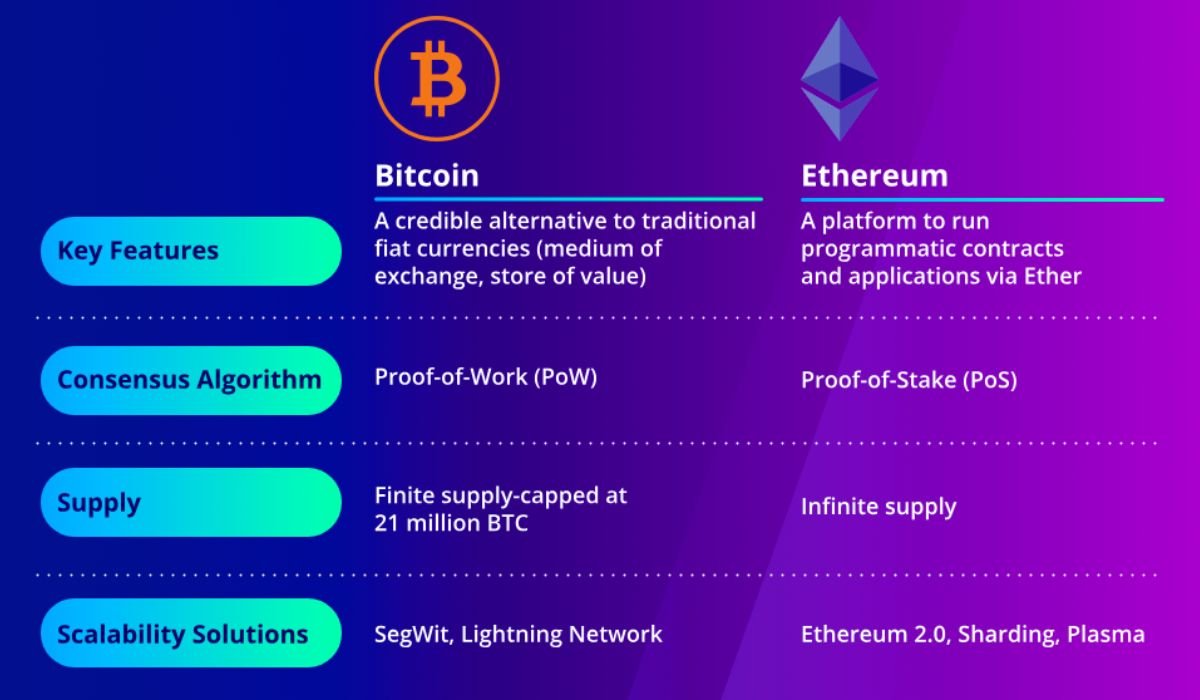

Bitcoin vs. Ethereum

While both cryptocurrencies aim to enhance scalability and security, their approaches differ. Bitcoin maintains a strict focus on being a secure, decentralized digital currency, while Ethereum aims to be a foundational layer for decentralized applications and finance.

Investment Perspective

From an investment standpoint, the risk profiles of Bitcoin and Ethereum vary. Bitcoin is seen as a digital gold and a hedge against inflation, while Ethereum offers exposure to a broader range of applications in finance, gaming, and art. Investors should consider their risk tolerance and investment horizon when evaluating these cryptocurrencies.

User and Investor Implications

What Users Need to Know

The enhancements in Bitcoin and Ethereum could lead to broader adoption. For users, this means improved security, faster transactions, and lower costs. Keeping abreast of these changes is crucial for anyone using these platforms to transfer value or execute contracts.

What Investors Should Consider

Investors should keep a close eye on regulatory developments and technological advancements, as these can significantly impact market prices and adoption rates. Consulting with financial advisors who understand the cryptocurrency market’s nuances is advisable.

Conclusion

The landscape of Bitcoin and Ethereum is one of constant evolution and improvement. As these platforms develop, they offer new opportunities and challenges for users and investors. Staying informed and understanding the technological underpinnings will be key to navigating this dynamic field successfully. As we look to the future, the continued innovation in Bitcoin and Ethereum is not just promising but essential, securing their place at the forefront of the cryptocurrency revolution.

FAQs About bitcoin and ethereum betterment

1. What does “betterment” mean for Bitcoin and Ethereum?

Answer: Betterment in the context of Bitcoin and Ethereum refers to technological upgrades and developments aimed at improving scalability, security, transaction speed, and overall efficiency of these cryptocurrencies.

2. How does the Taproot upgrade benefit Bitcoin users?

Answer: The Taproot upgrade enhances Bitcoin by making transactions more private and efficient. It allows for complex transactions to appear the same as standard ones on the blockchain, which also helps in reducing transaction fees and improving scalability.

3. What is Ethereum 2.0 and why is it important?

Answer: Ethereum 2.0 is a major update to the Ethereum blockchain, transitioning from a proof of work (PoW) to a proof of stake (PoS) consensus mechanism. This change is important because it significantly reduces Ethereum’s energy consumption and aims to increase transaction throughput via sharding.

4. Can Ethereum 2.0 reduce transaction costs?

Answer: Yes, one of the goals of Ethereum 2.0 is to reduce transaction costs by improving the network’s efficiency and scalability. The introduction of sharding and other Layer 2 solutions like Rollups are expected to decrease gas fees, especially during high network demand.

5. How do Bitcoin and Ethereum differ in their approach to scalability?

Answer: Bitcoin focuses on maintaining a robust and secure network with enhancements like the Lightning Network to facilitate faster transactions. Ethereum, on the other hand, aims to be a versatile platform supporting a wide range of applications, using solutions like sharding and Layer 2 technologies to improve scalability.

6. What should investors consider when looking at Bitcoin and Ethereum?

Answer: Investors should consider the different risk profiles and potential for growth. Bitcoin is often viewed as a store of value similar to gold, while Ethereum offers broader applications that could lead to higher returns but with potentially increased risks. Keeping an eye on regulatory developments and technological progress is also crucial.

7. Are there any risks associated with the betterment of these cryptocurrencies?

Answer: Yes, while improvements aim to enhance the networks, they also come with risks such as potential bugs in new software, untested upgrades, or shifts in market dynamics. Users and investors should stay informed and possibly seek advice from experts when navigating these changes.